Filed by the registrantþ

Filed by a party other than the registrant¨

Check the appropriate box:

| Filed by the registrant | þ | |||

| Filed by a party other than the registrant | o | |||

| Check the appropriate box: | ||

| o | Preliminary proxy statement | |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

permitted by Rule 14a-6(e)(2))

| þ | Definitive proxy statement |

| Definitive additional materials |

| Soliciting material pursuant to Rule 14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| (Name of Registrant as Specified in Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| Payment of filing fee (Check the appropriate box): | ||

| þ | No fee required. | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, schedule or registration statement no.: |

| (3) | Filing party: |

| (4) | Date filed: |

Reinsurance Group

at the Annual Meeting. Shareholders will be entitled to cast one vote on each matter for each share of common stock held of record on the record date. Any person giving such a proxy has the right to revoke it at any time before it is voted by giving written notice of revocation to the Secretary of the Company, by duly executing and delivering a proxy bearing a later date, or by attending the Annual Meeting and voting in person. date is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. Under Missouri corporate law, the approval of any action taken at the annual meeting is based on votes cast. If a quorum is present, the votes necessary to approve Items 1, 2 and 3, or to act on any other matters properly brought before the meeting, is the affirmative vote of the holders of a majority of the shares of our common stock entitled to vote which are present in person or represented by proxy at the 2014 Annual Meeting. that meeting. For additional information on the procedures for shareholder proposals, see “Director Qualifications and Nominations.” DIRECTORS New Directors Nominating & Governance Committee. Ms. Phillips was appointed to the Compensation Committee and Nominating & Governance Committee.

®NOTICE OF THE ANNUAL MEETING OFTHE SHAREHOLDERSOFREINSURANCE GROUPOF AMERICA, INCORPORATEDChesterfield, MissouriApril 8, 2013TO THE SHAREHOLDERS OFREINSURANCE GROUP OF AMERICA, INCORPORATEDChesterfield, MissouriApril 14, 2014To the Shareholders of Reinsurance Group of America, Incorporated:The Annual Meeting of the Shareholders of Reinsurance Group of America, Incorporated will be held at the Company’s principal executive offices located at 1370 Timberlake Manor Parkway, Chesterfield, Missouri 63017 on May 15, 2013,21, 2014, commencing at 2:00 p.m., at which meeting only holders of record of the Company’s common stock at the close of business on March 18, 201331, 2014 will be entitled to vote, for the following purposes:1. To elect two directors for terms expiring in 2016;2016 and three directors for terms expiring in 2017;2. To vote to approve the compensation of the Company’s named executive officers on a non-binding, advisory basis; 3.To vote to approve an amendment to the Company’s Flexible Stock Plan;4.To vote to re-approve the performance measures under the Company’s Annual Bonus Plan;5.To vote to re-approve the performance measures under the Company’s Flexible Stock Plan;6.To vote on a proposal to amend the Company’s Articles of Incorporation to declassify the Board of Directors;7.3.To ratify the appointment of Deloitte & Touche LLP as the Company’s independent auditor for the fiscal year ending December 31, 2013;2014; and8.4. To transact such other business as may properly come before the meeting. REINSURANCE GROUP OF AMERICA, INCORPORATED By

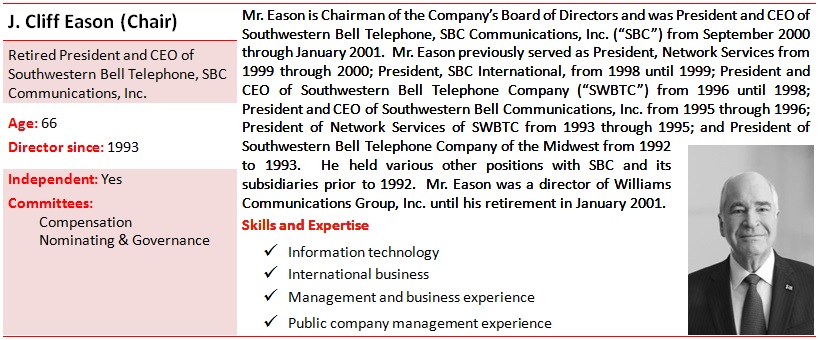

J. Cliff EasonChairman of the Board

J. Cliff EasonChairman of the Board William L. HuttonSecretaryTABLE OF CONTENTS

William L. HuttonSecretaryTABLE OF CONTENTSPage No.  PROXY STATEMENT SUMMARY

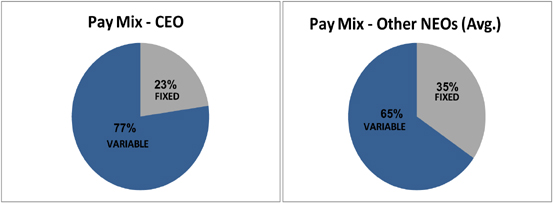

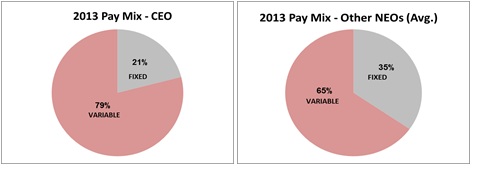

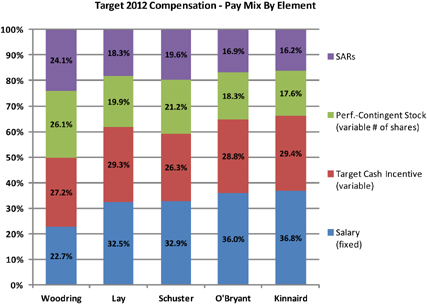

PROXY STATEMENT SUMMARYWilliam L. HuttonSecretaryYou have received these proxy materials because the Board of Directors is soliciting your proxy to vote your shares at the 2014 Annual Shareholders’ Meeting. This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references (“##”) are supplied to help you find additional information in this proxy statement. This proxy statement and the related proxy materials were first mailed to shareholders and made available on the internet on April 14, 2014.Annual Shareholders’ MeetingTime: May 21, 2014, 2:00 p.m., Central timePlace: 1370 Timberlake Manor Parkway, Chesterfield, Missouri 63017Record Date: Close of business on March 31, 2014Voting Matters and Board RecommendationsPROPOSAL BOARD VOTERECOMMENDATIONPAGE REFERENCE(FOR MORE DETAIL)Election of Directors FOR 3 Advisory Vote to Approve Executive Compensation FOR 44 Ratification of the appointment of Deloitte & Touche as Independent Auditor for fiscal 2014 FOR 45 How to Cast Your VoteYou can vote by any of the following methods:via the internet (www.investorvote.com/rga) by 11:59 p.m., Eastern Time, on May 20, 2014.via telephone by calling 1-800-652-VOTE (8683) by 11:59 p.m., Eastern Time, on May 20, 2014.if you received a proxy card or voting instruction form in the mail, by completing, signing, dating, and returning your proxy card in the return envelope provided to you in accordance with the instructions provided with the proxy card.in person, at the 2014 Annual Shareholders’ Meeting.Board Nominees (page 4)NAME DIRECTORSINCEINDEPENDENT ELECTION FORTERM ENDINGCOMMITTEEMEMBERSHIPSChristine R. Detrick 2014 Yes 2016 Audit; Nominating & Governance Joyce A. Phillips 2014 Yes 2016 Compensation; Nominating & Governance Arnoud W.A. Boot 2009 Yes 2017 Audit; FIRM John F. Danahy 2009 Yes 2017 Audit; Compensation J. Cliff Eason 1993 Yes 2017 Compensation; Nominating & Governance iInformation about our Board and its Committees (page 14) NUMBER OFMEMBERSPERCENTINDEPENDENTNUMBER OFMEETINGS IN2013Full Board 10 90% 8 Audit 4 100% 8 Compensation 5 100% 6 Finance, Investment, Risk Management 5 80% 7 Nominating & Governance 5 100% 5 Governance FactsSize of Board 10 Number of Independent Directors 9 Audit and Compensation Committees Comprised Entirely of Independent Directors Yes Independent Presiding Director Yes Separate Chairman and CEO Yes Majority Voting for Directors in Uncontested Elections Yes Advisory Vote on Executive Compensation Annual Annual Board and Committee Self-Evaluations Yes Stock Ownership Guidelines for Directors and Executive Officers Yes Restrictions on Hedging and Pledging of Company Shares for Directors and Employees Yes Executive Incentive Recoupment (Clawback) Policy Yes Shareholder Rights Plan (Poison Pill) No 2013 Business HighlightsAside from an after-tax charge of approximately $184 million, or $2.53 per diluted share, to increase claims liabilities in Australia in the second-quarter, 2013 full-year results were relatively strong including record revenues in excess of $10 billion. Summarized below are some key highlights of our financial performance for 2013:2013 total shareholder return (TSR) was 46.7%.Our net operating income for 2013 decreased 30.6% to $358.4 million, or $4.95 per diluted share.* The decrease was primarily attributable to the second-quarter charge in Australia, described above.Our net premiums increased $347.4 million, or 4.4%, compared to 2012.2013 revenues exceeded $10 billionFor additional information on our 2013 financial performance, see our 2013 Annual Report on Form 10-K.*See “Appendix A: Use of Non-GAAP Financial Measures” for reconciliations to GAAP figures.ii2013 Executive Compensation HighlightsANNUAL BONUS PLAN (based only on overall Company financial performance)Payout 38.4% of target Metric Actual Results % of Target Payout Operating Income Per Share $4.95/share 0.0% Annual Consolidated Revenue $10.3 billion 122.8% New Business Embedded Value $444 million 200.0% 2011-2013 PERFORMANCE CONTINGENT SHARE PROGRAM Payout To be approved late April 2014 Metric Actual Results % of Target Payout Cumulative Three-Year Revenue Metric 8.0% 75.8% Three-Year Operating Return on Equity (ROE) 10.3% 0.0% Three-Year Relative Return on Equity To be approved late April 2014 To be approved late April 2014 Primary Components of Executive Compensation (page 24)COMPONENT FORM KEY FEATURES Base Salary Cash ● Intended to attract and retain top talent ● Generally positioned near the 50th percentile of our pay level peer group, but varies with individual skills, experience, responsibilities, and performance● Represents approximately 31.9% of named executive officer (NEO) target total compensation for 2013 Annual BonusPlanCash ● Tied to one or more of the following factors: overall Company performance, performance of the participant’s division or business unit and/or individual performance ● Performance goals established at the beginning of each fiscal year ● Payouts range from 0% of target payout to 200% of target payout, depending on performance ● Intended to motivate annual performance with respect to key financial measures ● Represents approximately 27.9% of NEO target total compensation for 2013 PerformanceContingentSharesEquity ● Tied to the rate of revenue growth, ROE and Relative ROE performance over a three-year period ● Performance goals established at the beginning of each 3 year cycle ● Payouts range from 0% of target payout to 200% of target payout, depending on performance ● Intended to motivate intermediate performance with respect to key financial measures and align our NEOs’ interests with those of our shareholders ● Represents approximately 21.1% of NEO target total compensation for 2013 StockAppreciationRightsEquity ● Fully vests on the fourth anniversary of grant (25% per year) ● Intended to motivate long-term performance, promote appropriate risk-taking align our NEOs’ interests with shareholders’ interests and promote retention ● Represents approximately 19.1% of NEO target total compensation for 2013 iiiPROXY STATEMENT Page No. i1124The Board of Directors and Committees810111114172627272829Option and SARs Exercises and Stock Vested During Fiscal 20123232343536Securities Ownership of Directors, Management and Certain Beneficial Owners3840Item 2 — Shareholders’ Advisory Vote on Executive Compensation41Item 3 — Approval of Amendment to the Company’s Flexible Stock Plan42Item 4 — Approval of Performance Measures under the Company’s Annual Bonus Plan50Item 5 — Approval of Performance Measures under the Company’s Flexible Stock Plan5258Item 7 — Ratification of Appointment of the Independent Auditor6061iiInformation About the 2013 Annual Meeting and Proxy VotingEven though you may plan to attend the meeting, please mark, date, and execute the enclosed proxy and mail it promptly. A postage-paid return envelope is enclosed for your convenience.

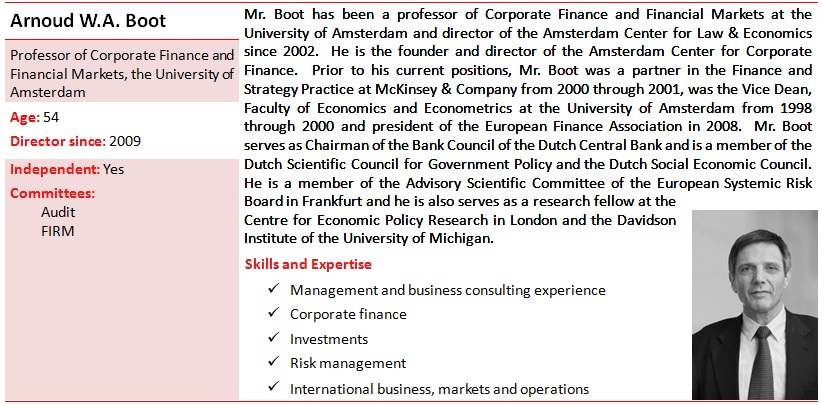

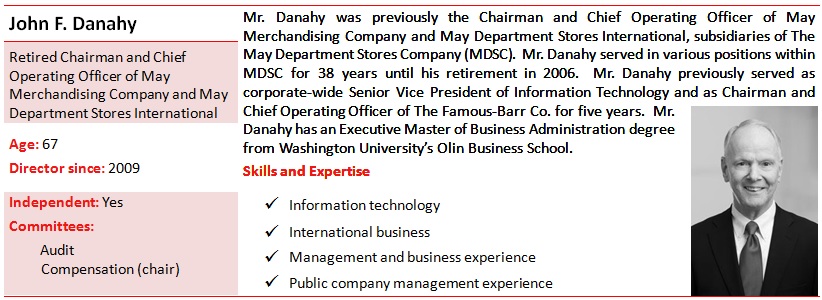

Reinsurance Groupof America, Incorporated®1370 Timberlake Manor ParkwayChesterfield, Missouri 63017-6039for theAnnual Meeting of the ShareholdersTo Be Held May 15, 2013at the Company’s Offices in Chesterfield, MissouriThis Proxy Statement is furnished to the holders of common stock of Reinsurance Group of America, Incorporated (the “Company”) is making this proxy solicitation in connection with the solicitation of proxies for use at theCompany’s 2014 Annual Meeting of the Shareholders (the “Annual Meeting”) to be held at 2:00 p.m. on May 15, 2013,21, 2014, and all adjournments and postponements thereof, for the purposes set forth in the accompanying Notice of the Annual Meeting of the Shareholders.thereof. The Company is first mailing this Proxy Statement and the enclosed Annual Report to Shareholders for the fiscal year ended December 31, 20122013 on or about April 8, 2013.Whether14, 2014. The solicitation will primarily be by mail and the expense thereof will be paid by the Company. In addition, proxies may be solicited by directors, officers, or not you expectregular employees of the Company in person, or by telephone, facsimile transmission or other electronic means of communication.The close of business on March 31, 2014 has been fixed as the record date for the determination of the Company shareholders entitled to attendvote at the Annual Meeting, you are requested to complete, sign,Meeting. As of the record date, and return the enclosed form of proxy. If you attend the meeting, you may vote by ballot. If you do not attend the meeting, yourapproximately 69,514,009 shares of common stock canwere outstanding and entitled to be voted only when represented by a properly executed proxy.Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting:The Company’s Notice of Annual Meeting, 2014 Proxy Statement and 2013 Annual Report toShareholders are available on the Company’s website at www.rgare.com.QUESTIONS AND ANSWERS ABOUT THE MEETING1. Who is entitled to vote and how many votes do I have?If you are a holder of record of Company common stock at the close of business on March 18, 2013 has31, 2014, you are eligible to vote at the 2014 Annual Meeting. For each matter presented for vote, you have one vote for each share you own.2. How do I vote?Your vote is important. Please cast your vote as soon as possible using one of the following methods.By Telephone or Internet. All shareholders of record also can vote by touchtone telephone within the U.S., U.S. territories and Canada, using the toll-free telephone number on the proxy card, or through the Internet, using the procedures and instructions described on the proxy card. The telephone and Internet voting procedures are designed to authenticate shareholders’ identities, to allow shareholders to vote their shares and to confirm that their instructions have been fixedrecorded properly.By Written Proxy. All shareholders of record can vote by written proxy card. If you received a proxy card or voting instruction form in the mail, you may vote by completing, signing, dating, and returning your proxy card in the return envelope provided to you in accordance with the instructions provided with the proxy card. If you sign and return your proxy card but do not mark any selections giving specific voting instructions, your shares represented by that proxy will be voted as recommended by the Board of Directors.In Person. All shareholders of record may vote in person at the meeting. Whether you plan to attend the meeting or not, we encourage you to vote by proxy as soon as possible. The proxy committee will vote your shares according to your directions.13. Can I change my vote?There are several ways in which you may revoke your proxy or change your voting instructions before the time of voting at the meeting please note that, in order to be counted, the revocation or change must be received by 11:59 p.m., Eastern Time, on May 20, 2014:Vote again by telephone or at the Internet website.Mail a revised proxy card or voting instruction form that is dated later than the prior one.Vote in person at the Annual Meeting.Notify the Company’s Corporate Secretary in writing that a prior proxy is revoked or voting instructions are changed.4. What is the voting requirement to approve each of the proposals and how are votes counted?At the close of business on March 31, 2014, the record date for the determination ofmeeting, the Company shareholders entitled to vote at the Annual Meeting. As of the record date, approximately 73,685,270had outstanding 69,514,009 shares of common stock were outstanding and entitled to be voted at the Annual Meeting. Shareholders will be entitled to cast one vote on each matter for eachstock. Each share of common stock held of recordoutstanding on the record date.Shareholder approval occurs if the votes cast in favor of the proposal exceed the votes cast against the proposal. “Votes cast” on these proposals means votes “for” or “against” a particular proposal, whether by proxy or in person. Abstentions and broker non-votes are not considered "votes cast" on these proposals and therefore have no effect on the outcome of these proposals. In uncontested elections, directors are elected by a majority of votes cast.5. Who pays for the solicitation of proxies?The Company pays the cost of soliciting proxies. Proxies will be solicited on behalf of the Board of Directors of the Company is making this proxy solicitation. The solicitation will primarily be by mail, and the expense thereof will be paid by the Company. In addition, proxies may be solicited by directors, officers, or regular employees of the Company in person, or by telephone, facsimile transmission or other electronic means or in person.6. How do I comment on Company business?Your comments are collected when you vote using the Internet. We also collect comments from the proxy card if you vote by mailing the proxy card. You may also send your comments to us in care of communication.Important Notice Regarding the AvailabilitySecretary at Reinsurance Group of Proxy MaterialsAmerica, Incorporated, 1370 Timberlake Manor Parkway, Chesterfield, Missouri 63017-6039. Although it is not possible to respond to each shareholder, your comments help us to understand your concerns.7. May I nominate someone to be a director of the Company?Yes. For information on the procedures for shareholder nominations of director candidates, see “Board of Directors - Director Qualifications and Nominations.”8. When are the Annual Meeting: This2015 shareholder proposals due?Shareholder proposals submitted under the process prescribed by the SEC (in Rule 14a-8 of the Exchange Act) for presentation at the 2015 annual meeting must be received by us by December 15, 2014, for inclusion in our Proxy Statement and our 2012 Annual Reportproxy relating to Shareholders are available atwww.rgare.com.2ITEM BOARD OF DIRECTORSITEM 1 — ELECTION- ELECTION OF DIRECTORSThe first item to be acted upon at the Annual Meeting is the election of WilliamArnoud W.A. Boot, John F. Danahy, Christine R. Detrick, J. BartlettCliff Eason and Alan C. HendersonJoyce A. Phillips as directors of the CompanyCompany. Mses. Detrick and Phillips stand for election to the Board for terms expiring at the annual meeting of the shareholders in 2016, or until their respective successors have been elected and qualified. Messrs. Boot, Danahy and Eason stand for re-election to the Board for terms expiring at the annual meeting of the shareholders in 2017 or until their respective successors have been elected and qualified. The Board nominates Messrs. Bartlettdirectors Boot, Danahy, Detrick, Eason and HendersonPhillips for election at the Annual Meeting. Each nominee is currently a director of the Company.RetirementAppointment of Rachel LomaxOn December 17, 2013, the Company announced the appointment of the dateChristine R. Detrick, former Director and Head of the Annual Meeting, Rachel Lomax will retire fromAmericas Financial Services Practice of Bain & Company, Inc., and Joyce A. Phillips, Chief Executive Officer, Global Wealth, Australia and New Zealand Banking Group Limited, to the Board, of Directors. Her position oneffective January 1, 2014. Ms. Detrick was appointed to the Board will remain vacant until her successor is electedAudit Committee and qualified.Nominees and Continuing DirectorsThe Board currently has nineten directors who are divided into three classes, eachtwo of which contains three directors. Following the Annual Meeting, the Board will have eight directors who will be divided into three classes, two of which will contain three directors and one will contain twoof which contains four directors. The term of office for each class is three years. Certain information with respect to the director nominees proposed by the Company and the other directors whose terms of office will continue after the Annual Meeting is set forth below.Should any one or more of the nominees be unable or unwilling to serve (which is not expected), the proxies (except proxies marked to the contrary) will be voted for such other person or persons as the Board may recommend.Vote RequiredIf a quorum is present, the vote required to approve this Item 1 is a majority of the common stock represented in person or by proxy at the Annual Meeting. The Company recommends a voteFOR the nominees for election to the Board.To Be Elected as Directors for Terms Ending in 2016:Director SinceWilliam J. Bartlett, 63Retired partner, Ernst & Young Australia. Mr. Bartlett was an accountant and consultant with Ernst & Young for over 35 years and advised numerous clients in the global insurance industry. Mr. Bartlett was appointed a partner of Ernst & Young in Sydney, Australia in July 1980, a position he held until his retirement in June 2003. He served as chairman of the firm’s global insurance practice from 1991 to 2000, and was chairman of the Australian insurance practice group from 1989 to 1998. Mr. Bartlett currently serves as an independent, non-executive director of Suncorp Group Limited, GWA Limited and the Abacus Property Trust, all of which are listed on the Australian Stock Exchange. Mr. Bartlett previously served as a member of the Australian Life Insurance Actuarial Standards Board and a consultant to the Australian Financial Reporting Council on Auditor Independence. He holds several professional memberships in Australia (ACPA and FCA), South Africa (CASA), and the United Kingdom (FCMA).2004Alan C. Henderson, 67Retired President and Chief Executive Officer of RehabCare Group, Inc. (“RehabCare”) from June 1998 until June 2003. Prior to becoming President and Chief Executive Officer, Mr. Henderson was Executive Vice President, Chief Financial Officer and Secretary of RehabCare from 1991 through May 1998. Mr. Henderson was a director of RehabCare from June 1998 to December 2003, Angelica Corporation from March 2001 to June 2003, and General American Capital Corp., a registered investment company, from October 1989 to April 2003.2002To Continue in Office Until 2015:Director SinceFrederick J. Sievert, 65Retired President of New York Life Insurance Company from 2002 through 2007. Mr. Sievert shared responsibility for overall company management in the Office of the Chairman, from 2004 until his retirement in 2007. Mr. Sievert joined New York Life in 1992 as Senior Vice President and Chief Financial Officer. In 1995, Mr. Sievert was promoted to Executive Vice President and was elected to the Board of Directors in 1996. In addition, he was President and a member of the board of New York Life Insurance and Annuity Corporation, served as Chairman of the Board of NYLIFE Insurance Company of Arizona, and served on the Board of Directors for Max New York Life, the company’s joint venture in India, Siam Commercial New York Life, the joint venture in Thailand, and the company’s South Korea operation. Prior to joining New York Life, Mr. Sievert was a senior vice president for Royal Maccabees Life Insurance Company, a subsidiary of the Royal Insurance Group of London, England. Mr. Sievert currently serves as a director of CNO Financial Group, Inc.2010Stanley B. Tulin, 63Retired Vice Chairman and CFO of AXA Financial, Inc. and its principle insurance subsidiary, AXA Equitable Life Insurance Company. Mr. Tulin joined AXA Equitable in 1996 as Senior Executive Vice President and CFO. In 1997, he became Executive Vice President and CFO of AXA Financial. In 1998, he was named Vice Chairman and a director of AXA Equitable, while remaining CFO of AXA Financial. He served on the AXA Group Executive Committee from 2000 through 2006. In his position at AXA, Mr. Tulin gained extensive experience in acquisitions and divestitures, consolidated risk management and financial communications. Since his retirement in 2006, Mr. Tulin has regularly consulted to AXA Financial, Inc. Prior to joining AXA Equitable, Mr. Tulin served as co-chairman of Coopers & Lybrand’s Insurance Industry Practice group and was part of the actuarial and strategic planning group at Milliman & Robertson, Inc. for 17 years. Mr. Tulin is a fellow of the Society of Actuaries and a member of the American Academy of Actuaries.2012A. Greig Woodring, 61President and Chief Executive Officer of the Company since 1993. Mr. Woodring headed the reinsurance business at General American Life Insurance Company from 1986 until the Company’s formation in December 1992. He also serves as a director and officer of a number of Company subsidiaries.1993To Continue in Office Until 2014:Director SinceArnoud W.A. Boot, 53Professor of Corporate Finance and Financial Markets at the University of Amsterdam and director of the Amsterdam Center for Law & Economics since 2002. Mr. Boot is the founder and director of the Amsterdam Center for Corporate Finance. Prior to his current positions, Mr. Boot was a partner in the Finance and Strategy Practice at McKinsey & Company from 2000 through 2001, was the Vice Dean, Faculty of Economics and Econometrics at the University of Amsterdam from 1998 through 2000 and president of the European Finance Association in 2008. Mr. Boot serves as Chairman of the Bank Council of the Dutch Central Bank and is a member of the Dutch Scientific Council for Government Policy and the Dutch Social Economic Council. He is a member of the Advisory Scientific Committee of the European Systemic Risk Board in Frankfurt and he is also a research fellow at the Centre for Economic Policy Research in London and the Davidson Institute of the University of Michigan.2009John F. Danahy, 66Retired Chairman and Chief Operating Officer of May Merchandising Company and May Department Stores International, subsidiaries of The May Department Stores Company (MDSC). Mr. Danahy served in various positions within MDSC for 38 years until his retirement in 2006. Mr. Danahy previously served as corporate-wide Senior Vice President of Information Technology and as Chairman and Chief Operating Officer of The Famous-Barr Co. for five years. Mr. Danahy has an Executive Master of Business Administration degree from Washington University’s Olin Business School.2009J. Cliff Eason, 65Retired President and CEO of Southwestern Bell Telephone, SBC Communications, Inc. (“SBC”), a position he held from September 2000 through January 2001. Mr. Eason served as President, Network Services from 1999 through 2000; President, SBC International, from 1998 until 1999; President and CEO of Southwestern Bell Telephone Company (“SWBTC”) from 1996 until 1998; President and CEO of Southwestern Bell Communications, Inc. from 1995 through 1996; President of Network Services of SWBTC from 1993 through 1995; and President of Southwestern Bell Telephone Company of the Midwest from 1992 to 1993. He held various other positions with SBC and its subsidiaries prior to 1992. Mr. Eason was a director of Williams Communications Group, Inc. until his retirement in January 2001.19933To Be Elected as Director for Term Ending in 2016

To Be Elected as Directors for Terms Ending in 2017

To Be Elected as Directors for Terms Ending in 2017 4

4

CORPORATE GOVERNANCE

We have adopted a Principles

Directors

Qualifications of Directors

Following the Annual Meeting, the Board of Directors will beis made up of eightten individuals, each with a valuable core set of skills, talents and attributes that make them appropriate for our Company’s Board as a whole. When searching for new Board candidates, the Nominating and Governance Committee considers the evolving needs of the Company’s global business and searches for Board candidates that fill any current or anticipated future needs or gaps in skills and experience. As determined by our Board and the Nominating and Governance Committee, all of our directors possess the following qualifications: financial literacy, leadership experience, commitment to the Company’s values, absence of conflicting commitments, and knowledge and experience that will complement that of other directors and promote the creation of shareholder value. Other areas of expertise or experience are desirable given our Company’s global reinsurance business and operations and the current make-up of the Board, such as expertise or experience in: life insurance, financial services, information technology, international markets, operations, capital markets, investments, banking, risk management, public company service and actuarial science. The process undertaken by the Nominating and Governance Committee in recommending qualified director candidates is described under “Additional Information – Shareholder“Shareholder Nominations and Proposals.”

All of our directors bring significant executive leadership derived from their careers and professions. When considering whether our current directors had the experience, qualifications, attributes and skills, taken as a whole, to enable the Board of Directors to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Nominating and Governance Committee and the Board of Directors focused primarily on the information discussed in each of the directors’ individual biographies described above.

William J. Bartlett:

| ü | Financial Literacy | Such person should be “financially literate” as such qualification is interpreted by the Board in its business judgment. |

| ü | Leadership Experience | Such person should possess significant leadership experience, such as experience in business, finance/accounting, law, education or government, and shall possess qualities reflecting a proven record of accomplishment and ability to work with others. |

| ü | Commitment to Our Values | Such person shall be committed to promoting our financial success and preserving and enhancing our business and ethical reputation, as embodied in our codes of conduct and ethics. |

| ü | Absence of Conflicting Commitments | Such person should not have commitments that would conflict with the time commitments of a director. |

| ü | Reputation and Integrity | Such person shall be of high repute and recognized integrity and not have been convicted in a criminal proceeding (excluding traffic violations and other minor offenses). Such person shall not have been found in a civil proceeding to have violated any federal or state securities or commodities law, and shall not be subject to any court or regulatory order or decree limiting his or her business activity, including in connection with the purchase or sale of any security or commodity. |

| ü | Knowledge and Experience | Such person should possess knowledge and experience that will complement that of other directors and promote the creation of shareholder value. |

| ü | Other Factors | Such person shall have other characteristics considered appropriate for membership on the Board, including an understanding of marketing and finance, sound business judgment, significant experience and accomplishments and educational background. |

| Elements of Director Compensation | ||

| Annual Retainer | ||

| Chairman of the Board | $83,000 | |

| Audit Committee Chair | $62,000 | |

| Other Committee Chairs | $58,000 | |

| All other independent directors | $50,000 | |

| Payments Per Meeting | ||

| Chairman of the Board | $4,000 for attending in person | |

| $2,000 for telephonic meetings | ||

| All other independent directors | $3,000 for attending in person | |

| $1,500 for telephonic meetings | ||

| Annual Stock Grants | ||

| Chairman of the Board | 2,125 shares | |

| All other independent directors | 1,725 shares | |

| 2013 DIRECTOR COMPENSATION | ||||

| NAME | FEES EARNED OR PAID IN CASH1 | STOCK AWARDS2 | ALL OTHER COMPENSATION3 | TOTAL |

| William J. Bartlett | $111,500 | $101,378 | $96,9524 | $309,830 |

| Arnoud W.A. Boot | $105,500 | $101,378 | $5,194 | $212,072 |

| John F. Danahy | $112,000 | $101,378 | --- | $213,378 |

| J. Cliff Eason | $139,500 | $124,886 | $11,578 | $275,964 |

| Alan C. Henderson | $107,500 | $101,378 | $31,429 | $240,307 |

Rachel Lomax5 | $50,500 | $101,378 | --- | $151,878 |

| Fred J. Sievert | $107,500 | $101,378 | --- | $208,878 |

| Stanley B. Tulin | $90,500 | $101,378 | $15,018 | $206,896 |

| 1. | This column reflects the retainer and fees earned in 2013 for Board and committee service. The 2013 retainer was paid in January 2013 and the 2013 Board and committee meeting fees were paid in January 2014. |

| 2. | This column reflects the award of 1,725 shares (2,125 shares in the case of Mr. Eason) of common stock on February 21, 2013, at a closing market price of $58.77. The stock is issued as part of the directors’ annual compensation. For additional information on the valuation assumptions, refer to note 16 of the Company’s financial statements in the Form 10-K for the year ended December 31, 2013, as filed with the SEC. Mr. Eason elected to defer his stock awards under the Flexible Stock Plan. |

| 3. | This column includes 2013 reimbursement to the director for spousal travel expenses incurred in connection with attending the October meeting of the Board of Directors, which is usually held in one of the Company’s global offices outside the U.S. Under U.S. tax laws, the amount of such reimbursement for spousal travel must be included on the Form 1099-MISC that is issued annually by the Company to each director. Directors are responsible for payment of any taxes they incur because of the reimbursement for spousal travel expenses. The amount for Mr. Henderson also reflects reimbursement for spousal travel expenses he incurred in 2011 and 2012. |

| 4. | Represents compensation for services as a director of our Australian holding and operating companies. Australian dollars converted to U.S. dollars using an annualized currency exchange rate. |

| 5. | Ms. Lomax retired from the Board of Directors on May 15, 2013. |

| PHANTOM OR DEFERRED SHARE OWNERSHIP | |

| NAME | PHANTOM OR DEFERRED SHARES |

| William J. Bartlett | 5,631 |

| J. Cliff Eason | 22,758 |

| Alan C. Henderson | 1,086 |

Arnoud W.A. Boot: managementGovernance Guidelines and business consulting experience; corporate finance; investments; risk management; international business, marketsCharters

John F. Danahy: information technology; international business, marketsa Financial Management Code of Professional Conduct (the “Financial Management Code”). The Principles apply to all employees and operations; public company management experience

J. Cliff Eason: information technology; international business, marketsofficers of the Company and operations; public company management experience

Alan C. Henderson: audit committee experience; experience as CEOits subsidiaries. The Directors’ Code applies to directors of the Company and CFO of a public company; public company accounting and finance

Frederick J. Sievert: experience as an executive officer of a major U.S.-based life insurance company with international operations; life insurance business and market; insurance regulation; financial reporting; investments; risk management; international business, markets and operations

Stanley B. Tulin: experience as an executive officer of a major global financial services company; actuarial consulting experience; audit committee experience; consolidated risk management experience; mergers and acquisitions consulting experience; financial services and life insurance knowledge

A. Greig Woodring: asits subsidiaries. The Financial Management Code applies to our President and Chief Executive Officer, since 1993, extensive personal knowledgeChief Financial Officer, Corporate Controller, primary financial officers in each business unit, and all professionals in finance and finance-related departments. We intend to satisfy any disclosure obligations under Item 5.05 of Form 8-K by posting on our website information about amendments to, or waivers from, any provision of the Company’s business, operations, customersFinancial Management Code that applies to our chief executive officer, chief financial officer and industry

Contents May. We believe that these decreased payouts in a year with lower overall Company performance philosophy. Our net premiums increased Our net operating income for Our annualized operating return on equity was Our book value per share, excluding Accumulated Other Comprehensive Income, increased 2013.The Board of Directors has adopted Corporate Governance Guidelines and charters for the Audit, Compensation, Nominating and Governance and Finance, Investment and Risk Management Committees (collectively, the “Governance Documents”). These codes of conduct and Governance Documents are available on our website at www.rgare.com. Information on our website does not constitute part of this Proxy Statement. We will provide without charge, upon request, a copy of any of the codes of conduct or Governance Documents. Requests should be directed to Investor Relations at 1370 Timberlake Manor Parkway, Chesterfield, Missouri 63017, by electronic mail (investrelations@rgare.com) or by telephone (636-736-7000).Director IndependenceIn accordance with the Corporate Governance Guidelines, the Board undertook reviews of director independence in February 20122013 and February 2013.2014. During these reviews, the Board received a report from the Company’s General Counsel noting that there were no transactions or relationships between the Company or its subsidiaries and any of the independent directors (i.e., Messrs. Bartlett, Boot, Danahy, Eason, Henderson, Sievert or Tulin and Ms. Lomax in 2013 and Messrs. Bartlett, Boot, Danahy, Eason, Henderson, Sievert or Ms. Lomax)Tulin and Mses. Detrick and Phillips in 2014) nor any member of such director’s immediate family. The purpose of this review was to determine whether any of those directors had a material relationship with us that would preclude such director from being independent under the listing standards of the New York Stock Exchange (“NYSE”) or our Corporate Governance Guidelines.As a result of this review, the Board affirmatively determined, in its judgment, that each of the current eightnine directors named above are independent of us and our management under the applicable standards. Mr. Woodring is a non-independent director because he is our Chief Executive Officer.11Board DiversityAlthough we do not have a formal written policy with respect to diversity, the Board believes that it is essential that directors represent diverse perspectives, skills and experience. When evaluating the various qualifications, experiences and backgrounds of Board candidates, the Board reviews and discusses many aspects of diversity such as gender, race, national origin, education, professional experience, geographic representation and differences in viewpoints and skills. To the extent possible, director recruitment efforts include several of these factors and the Board strives to recruit candidates that enhance the Board’s diversity.Board Leadership StructureIn recognition of the differences between the two roles and in order to maximize effective Board leadership, our Company has separated the position of Chief Executive Officer and Chairman of the Board since we became public in 1993. The CEO is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while the Chairman of the Board provides guidance to the CEO, sets the agenda for Board meetings, presides over meetings of the full Board and presides at the regularly scheduled executive sessions of the independent directors.The Board’s Role in Risk OversightThe Board has an active and ongoing role, as a whole and also at the committee level, in overseeing management of the Company’s risks. The Board of Directors has established a Finance, Investment and Risk Management (“FIRM”) Committee to assist the Board with its oversight responsibilities and strengthen and support efforts to promote best practices in the Company’s enterprise risk management activities. The FIRM Committee reviews, monitors, and when appropriate, approves the Company’s programs, policies and strategies relating to financial and investment risks and overall enterprise risk management. In addition, the Audit Committee oversees management of risks related to accounting and financial reporting and reviews reports on ethics and compliance matters each quarter. The Compensation Committee is responsible for overseeing the management of risks relating to the Company’s employee compensation policies, practices, plans and arrangements, including executive retention. The Nominating and Governance Committee manages risks associated with the independence of the Board of Directors, leadership development and CEO succession planning, and reviews any potential conflicts of interest.planning. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, Committee meetings are scheduled so the entire Board of Directors (including directors who are not actual committee members) are able to participate in Committee meetings and stay apprised of the risks monitored and discussed by each Committee. In addition, each Committee provides recommendations to the full Board as required or appropriate.Risk Considerations in our Compensation ProgramThe Compensation Committee considers the risks associated with our compensation policies and practices, with respect to both executive compensation and compensation generally. The Compensation Committee continually considers the Company’s long-standing culture which emphasizes incremental continuous improvement and sustained long-term shareholder value creation, and ensures that these factors are reflected in the design of the Company’s compensations plans. Our compensation program is structured so that a considerable amount of our incentive-eligible employees’ compensation is tied to the long-term health of the Company. We avoid the type of disproportionately large, annual incentives that could encourage employees to take risks that may not be in our shareholder’s long-term interests, and we weight our management’s incentive compensation toward profitability and long-term performance. We believe this combination of factors encourages our executives and other employees to manage the Company in a prudent manner with a focus on increasing long-term shareholder value. Furthermore, as described in “Compensation Discussion and Analysis” below, the Compensation Committee may exercise full discretion and include subjective considerations in its incentive compensation decisions, which restrain the influencedecisions.12While a significant portion of our executive compensation plan is performance-based, we do not believe that our program encourages excessive or unnecessary risk-taking. Risk-taking is a fundamental and necessary part of our business, and our Compensation Committee has focused on aligning the Company’s compensation policies with the Company’s long-term interests and avoiding short-term rewards for management decisions that could pose long-term risks to the Company. The following policies and practices emphasize the Compensation Committee’s focus on balancing risk with reward:•Annual Bonus Plan. Our Annual Bonus Plan (“ABP,” formerly called Management Incentive Plan) is designed to reinforce our pay for performance culture by making a significant portion of management’s annual bonus compensation variable. ABP awards are based solely on Company results or on a combination of Company, business unit and/or individual performance. The ABP aligns annual cash bonus compensation with our short-term business strategies and the targets reflect our short-term goals for operating income per share and revenue growth. The Compensation Committee sets award levels with a minimum level of performance that must be met before any payment can be made. To further ensure that there is not a significant incentive for unnecessary risk-taking, we cap the payout of these awards at 200% of the target.•Performance Contingent Stock Grants. Our performance contingent stock (“PCS”) grants are a three year performance-driven incentive program that reinforces our intermediate-term strategic, financial and operating goals. Annual grants of PCS are designed to reward the achievement of specific intermediate-term corporate financial performance goals. The measures used for the PCS grants are an important means of aligning the economic interests of management and shareholders. The Compensation Committee sets award levels with a minimum level of performance that must be met before any payment can be made. To further ensure that there is not a significant incentive for unnecessary risk-taking, we cap the payout of these awards at 200% of target. We measure performance for the PCS grants based 33.5% on operating return on equity, 33.5% on relative return on equity compared to an established peer group and 33.0% on a compound annual growth rate for revenue, all calculated as of the end of the applicable three-year performance period.•Long-term Incentive Compensation. Our Flexible Stock Plan provides for the award of various types of long-term equity incentives, including stock options and stock appreciation rights (“SARs”), to associates who have the ability to favorably affect our business and financial performance. We believe that stock options and SARs provide the most appropriate vehicle for providing long-term value to management because of the economic tie to shareholder value. In 2011, we replaced stock option grants with SARs grants as our means of providing long-term incentive compensation. We believe annual grants of SARs allow us to reward the achievement of long-term goals and are based on our desire to achieve an appropriate balance between the overall risk and reward for short, intermediate and long-term incentive opportunities.•Share Ownership Guidelines. Our share ownership guidelines require members of senior management to hold a specified value of Company stock which is based on the level of their role and responsibility in the organization. This ensures that our senior management will have a significant amount of value tied to long-term holdings in Company stock.•Executive Incentive Recoupment Policy. In February 2013, the Board adopted an Executive Incentive Recoupment Policy, which permits the Company to recoup all or a portion of incentive awards paid to certain executives upon the occurrence of certain recoupment events. Such events include: (i) a financial restatement due to the material noncompliance with any financial reporting requirement under the federal securities laws; (ii) receiving an incentive award based on materially inaccurate financial statements or any other materially inaccurate performance metric criteria; (iii) causing injury to the interests or business reputation of the Company or of a business unit whether due to violations of law, regulatory sanctions or otherwise; and (iv) a material violation of the Company’s Principles of Ethical Business Conduct. The Compensation Committee has express authority to interpret and administer the policy, implement various remedies based on the circumstances triggering the recoupment and make all determinations with respect to the policy in its sole discretion.Annual Bonus Plan. Our Annual Bonus Plan (“ABP”) is designed to reinforce our pay for performance culture by making a significant portion of management’s annual compensation variable. ABP awards are based solely on Company results or on a combination of Company, business unit and/or individual performance. The ABP aligns annual cash bonus compensation with our short-term business strategies and the targets reflect our short-term goals for operating earnings per share, revenue growth and new business embedded value. The Compensation Committee sets award levels with a minimum level of performance that must be met before any payment can be made. To further ensure that there is not a significant incentive for unnecessary risk-taking, we cap the payout of these awards at 200% of the target.Performance Contingent Share Grants. Our performance contingent share (“PCS”) grants are a three-year performance-driven incentive program that reinforces our intermediate-term strategic, financial and operating goals. Annual grants of PCS are designed to reward the achievement of specific intermediate-term corporate financial performance goals. The measures used for the PCS grants are an important means of aligning the economic interests of management and shareholders. The Compensation Committee sets award levels with a minimum level of performance that must be met before any payment can be made. To further ensure that there is not a significant incentive for unnecessary risk-taking, we cap the payout of these awards at 200% of target. We measure performance for the PCS grants based 33.5% on operating return on equity, 33.5% on relative return on equity compared to an established peer group and 33.0% on a compound annual growth rate for revenue, all calculated as of the end of the applicable three-year performance period.Long-term Incentive Compensation. Our Flexible Stock Plan provides for the award of various types of long-term equity incentives, including stock appreciation rights (“SARs”) and stock options to associates who have the ability to favorably affect our business and financial performance. In 2011, we replaced stock option grants with SARs grants as our means of providing long-term incentive compensation. We believe that SARs provide the most appropriate vehicle for providing long-term value to management because of the economic tie to shareholder value. We believe annual grants of SARs allow us to reward the achievement of long-term goals and are based on our desire to achieve an appropriate balance between the overall risk and reward for short, intermediate and long-term incentive opportunities.Share Ownership Guidelines. Our share ownership guidelines require members of senior management to hold a specified number of shares of Company stock which is based on the level of their role and responsibility in the organization. This ensures that our senior management will have a significant amount of value tied to long-term holdings in Company stock.13Executive Incentive Recoupment Policy. In February 2013, the Board adopted an Executive Incentive Recoupment Policy, which permits the Company to recoup all or a portion of incentive awards paid to certain executives upon the occurrence of certain recoupment events. Such events include: (i) a financial restatement due to the material noncompliance with any financial reporting requirement under the federal securities laws; (ii) receiving an incentive award based on materially inaccurate financial statements or any other materially inaccurate performance metric criteria; (iii) causing injury to the interests or business reputation of the Company or of a business unit whether due to violations of law, regulatory sanctions or otherwise; and (iv) a material violation of the Company’s Principles of Ethical Business Conduct. The Compensation Committee has express authority to interpret and administer the policy, implement various remedies based on the circumstances triggering the recoupment and make all determinations with respect to the policy in its sole discretion.Communications with the Board of DirectorsThe Board of Directors has posted the process whereby interested parties and shareholders can communicate with our directors and the Board on our website at www.rgare.com. Interested parties and shareholders may communicate directly with our Chairman of the Board, Mr. Eason, by sending a written communication as follows:General CounselReinsurance Group of America, Incorporated1370 Timberlake Manor ParkwayChesterfield, Missouri 63017The process for communicating with the Board provides that the General Counsel will make a record of the receipt of any such communications. All properly addressed communications will be delivered to the specified recipient(s) not less than once each calendar quarter, and will not be directed to or reviewed by management prior to receipt by such persons.Board MeetingsThe Board of Directors held a total of seven regular meetings and no specialeight meetings during 2012.2013. Each incumbent director attended at least 75% of the meetings of the Board and committees on which he or she served during 2012.2013. We do not have a policy with regard to attendance by directors at the Annual Meeting. The Chairman of the Board attended the 20122013 annual meeting of shareholders.BOARD COMMITTEESThe Board of Directors has an Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), a Compensation Committee, a Nominating and Governance Committee, and a Finance, Investment and Risk Management Committee.14Audit Committee Committee Members Roles and Responsibilities William J. Bartlett*Arnoud W.A. BootChristine R. DetrickJohn F. Danahy*Chairü Responsible for the appointment, compensation, retention and oversight of the work of our independent auditor ü Oversees our accounting and financial reporting processes and policies and the integrity of our financial statements ü Supervises the adequacy of our internal controls over financial reporting and disclosure controls and procedures Number of Meetings in 2013: 8ü Pre-approves audit, audit-related, and non-audit services to be performed by the Company’s independent auditor ü Reviews reports concerning significant legal and regulatory matters ü Reviews the plans and performance of our internal audit function ü Reviews and discusses our filings on Forms 10-K and 10-Q, including the financial information in those filings Independence and Financial Literacy ü The Board has determined that the members are “independent” within the meaning of Securities and Exchange Commission (“SEC”) regulations applicable to audit committees and the NYSE listing standards ü The Board has determined that the members have accounting and related financial management expertise within the meaning of the NYSE listing standards ü The Board has determined that all the members are qualified as audit committee financial experts within the meaning of SEC regulations Compensation Committee Committee Members Roles and Responsibilities John F. Danahy*J. Cliff EasonJoyce A. PhillipsFrederick J. SievertStanley B. Tulin*Chairü Establishes and oversees our general compensation and benefits programs ü Reviews and approves the performance and compensation of the CEO, other named executive officers and members of our senior management ü Sets performance measures and goals and verifies the attainment of performance goals under performance-based incentive compensation plans Independence Number of Meetings in 2013:6ü The Board of Directors has determined, in its judgment, that all of the Committee’s members are independent within the meaning of the NYSE listing standards. ü For purposes of its independence determination, the Board considered the enhanced independence standards for compensation committees under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 which are required by the SEC for the listing standards of national securities exchanges. Interlocks and Insider Participationü The members of the Compensation Committee are not and have never been officers or employees of the Company or any of its subsidiaries. ü No directors or executive officers of our Company serve on the compensation committee of another company of which a member of our Compensation Committee is an officer. 15Finance, Investment and Risk Management Committee Committee Members Roles and Responsibilities Alan C. Henderson*William J. BartlettArnoud W.A. BootStanley B. TulinA. Greig Woodring*Chairü Assists the Board in connection with its oversight responsibilities for the Company’s risk, investment and finance policies, programs, procedures and strategies ü Reviews, monitors, and when appropriate, approves the Company’s programs, policies and strategies relating to financial and investment risks and overall enterprise risk management Number of Meetings in 2013: 7Nominating & Governance Committee Committee Members Roles and Responsibilities Frederick J. Sievert*Christine R. DetrickJ. Cliff EasonAlan C. HendersonJoyce A. Phillips*Chairü Develops and implements policies and practices relating to corporate governance ü Reviews and monitors implementation of our Corporate Governance Guidelines ü Identifies individuals qualified to become members of the Board, consistent with the criteria established by the Board; develops and reviews background information on candidates for the Board; and makes recommendations to the Board regarding such candidates Number of Meetings in 2013:5ü Prepares and supervises the Board’s annual review of director independence and the performance of self-evaluations conducted by the Board and Committees ü Oversees the succession planning process for our CEO, which includes reviewing development plans for potential successors, evaluating potential internal and external successors for executive and senior management positions, and development and periodic review of the Company’s plans for CEO succession in various circumstances Independence ü The Board of Directors has determined, in its judgment, that all of the Committee’s members are independent within the meaning of the NYSE listing standards Committee assignments listed above are effective as of January 1, 2014. Effective on such date, several committee assignments changed: Mses. Detrick and Phillips were appointed to the Board, with Ms. Detrick joining the Audit CommitteeTheand Nominating & Governance committees and Ms. Phillips joining the Compensation and Nominating & Governance committees; additionally, Mr. Tulin left the Audit Committee met eight times in 2012. On January 1, 2012, the Committee consisted of Messrs. Bartlett (Chairman), Boot, Danahy and Ms. Lomax. Mr. Tulin joined the Committee on January 26, 2012 and Ms. Lomax will retire from the Committee following the Annual Meeting. The Committee is directly responsible for the appointment, compensation, retention and oversight of the work of our independent auditor. The Committee oversees our accounting and financial reporting processes, the adequacy of our internal controls over financial reporting and disclosure controls and procedures, the integrity of our financial statements, pre-approves all audit and non-audit services to be provided by the independent auditor, reviews reports concerning significant legal and regulatory matters, and reviews the plans and performance of our internal audit function. The Committee also reviews and discusses our filings on Forms 10-K and 10-Q, including the financial information in those filings. The Audit Committee works closely with management as well as our independent auditor and internal auditor. FIRM committee.A more detailed description of the roleroles and responsibilities of the Audit Committeeeach committee is set forth in a written charter, adopted by the Board ofDirectors,committee charters, which isare available on our website (www.rgare.com). The Audit Committee has established procedures16CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONSReview and Approval of Related Person Transactions. We do not have any agreements, transactions or relationships with related persons such as directors, nominees, executive officers or immediate family members of such individuals. At least annually we review all relationships between our Company and our directors and executive officers and their immediate family members to determine whether such persons have a direct or indirect material interest in any transaction with us. Our Global Legal Services staff is primarily responsible for the receipt, retention,development and treatmentimplementation of complaints regarding financial reporting, internal accountingprocesses and controls to obtain information from the directors, nominees and executive officers with respect to related person transactions. If such a transaction arose, our Global Legal Services staff would determine, based on the facts and circumstances, whether we or auditing matters. Please seea related person has a direct or indirect material interest in the process regarding contacting the Audit Committee on our website (www.rgare.com).Thetransaction. As required under SEC rules, related person transactions that are determined to be directly or indirectly material to us are disclosed in this Proxy Statement and other SEC filings.Our Board of Directors has determined, inadopted a policy as part of its judgment,corporate governance guidelines that all of the members of the Audit Committee:are independent within the meaning of Securities and Exchange Commission (“SEC”) regulations applicable to audit committees and the NYSE listing standards;are qualified as audit committee financial experts within the meaning of SEC regulations; andhave accounting and related financial management expertise within the meaning of the NYSE listing standards.The Audit Committee Charter provides that members of the Audit Committee may not simultaneously serve on the audit committee of more than two other public companies, unless such member satisfactorily demonstrates that he or she has the ability to devote the time and attention required to serve on multiple audit committees.Compensation CommitteeThe Compensation Committee met five times during 2012. On January 1, 2012, the Committee consisted of Messrs. Danahy (Chairman), Boot, Eason and Sievert. Mr. Tulin joined the Committee on January 26, 2012 and on that date Mr. Boot moved to the Finance, Investment and Risk Management Committee. The Committee meets as often as necessary to perform its duties and responsibilities, which include establishing and overseeing our general compensation policies, reviewing and approving the performance and compensation of the CEO, other named executive officers and members of our senior management. A more detailed description of the role and responsibilities of the Compensation Committee is set forth in a written charter adoptedrequires advance approval by the Board of Directors, which is available on our website (www.rgare.com). The Board of Directors has determined, in its judgment, that allbefore any of the Committee’s members are independent within the meaning of the NYSE listing standards. For purposes of its independence determination, the Board considered the enhanced independence standards for compensation committees under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 which are required by the SEC for the listing standards of national securities exchanges.Compensation Committee Interlocks and Insider Participation. The members of the Compensation Committee are not and have never been officers or employees offollowing persons knowingly enter into any transaction with the Company or any of its subsidiaries. No directorsour subsidiaries or affiliates through which such person receives any direct or indirect financial, economic or other similar benefit or interest. The individuals covered by the policy include:any director,any nominee for director,any executive officersofficer,any holder of more than 5% of our Company serve on the compensation committee of another company of which avoting securities,any immediate family member of our Compensation Committeesuch a person, as that term is an officer.Nominatingdefined in the policy, and Governance CommitteeThe Nominating and Governance Committee met four times in 2012. Since January 1, 2012, the Committee consistedany charitable entity or organization affiliated with such person or any immediate family member of Messrs. Sievert (Chairman), Eason and Henderson. This Committee is responsible for developing and implementing policies and practices relating to corporate governance, including reviewing and monitoring implementation of our Corporate Governance Guidelines. In addition, the Committee identifies individuals qualified to become members of the Board, consistent with the criteria establishedsuch person.Transactions covered by the Board; develops and reviews background information on candidatespolicy include any contract, arrangement, understanding, relationship, transaction, contribution or donation of goods or services, but exclude transactions with any charitable entity or organization affiliated with a director, nominee for the Board; and makes recommendations to the Board regarding such candidates. The Committee also prepares and supervises the Board’s annual review of director, independence and the performance of self-evaluations conducted by the Board and Committees. The Committee oversees the succession planning process for our CEO, which includes reviewing development plans for potential successors, evaluating potential internal and externalsuccessors for executive and senior management positions, and development and periodic review of the Company’s plans for CEO succession in various circumstances. A more detailed description of the role and responsibilities of the Nominating and Governance Committee is set forth in a written charter adopted by the Board of Directors, which is available on our website (www.rgare.com). The Board of Directors has determined, in its judgment, that all of the Committee’s members are independent within the meaning of the NYSE listing standards. Shareholders wishing to propose nominees to the Committee for consideration should notify in writing our Secretary in accordance with the process described in “Additional Information — Shareholder Nominations and Proposals.” The Secretary will inform the members of the Committeeofficer, 5% security holder or any immediate family member of such nominees.Finance, Investment and Risk Management CommitteeThe Finance, Investment and Risk Management Committee met six timesa person if the amount involved is $2,500 or less. At this time, the Company is not involved in 2012. On January 1, 2012, the Committee consistedany transactions that would be covered by this policy.17Table of Messrs. Henderson (Chairman), Bartlett, Woodring and Ms. Lomax. Mr. Boot joined the Committee on January 26, 2012 and Ms. Lomax will retire from the Committee following the Annual Meeting. This Committee is responsible for assisting the Board in connection with its oversight responsibilities for the Company’s risk, investment and finance policies, programs, procedures and strategies. In addition, the Committee reviews, monitors, and when appropriate, approves the Company’s programs, policies and strategies relating to financial and investment risks and overall enterprise risk management. A more detailed description of the role and responsibilities of the Finance, Investment and Risk Management Committee is set forth in a written charter adopted by the Board of Directors, which is available on our website (www.rgare.com).COMPENSATION DISCUSSIONAND ANALYSISCOMPENSATION DISCUSSION & ANALYSISOur executive compensation program is designed to attract and retain the senior level employees who direct and lead our business and to reward these individuals for superior financial performance. Our Board of Directors has delegated to the Compensation Committee the authority to establish and oversee our general compensation policies,program, review the performance and approve the compensation of our Chief Executive Officer, and review and approve the compensation of the other Named Executive Officers and members of our senior management. The Compensation Committee also producesreviews and approves this compensation discussion and analysis on executive compensation for inclusion in this Proxy Statement (the “CD&A”). Since January 26, 2012,During 2013, the Compensation Committee has consisted of Messrs. Danahy (Chairman), Eason, Sievert and Tulin.Named Executive OfficersIn 2011 Effective January 1, 2014, Ms. Phillips joined the Company restructured, creating new executive opportunities designed to ensure that the Company is appropriately positioned to take advantage of emerging global opportunities. As a result of this restructuring and costs associated with the relocation of two executives to our St. Louis headquarters, ourCompensation Committee.Our named executive officers have changed for 2012 and2013 are as follows: A. Greig Woodring –- President and Chief Executive Officer, Officer;Jack B. Lay –- Senior Executive Vice President and Chief Financial Officer, Officer;Paul A. Schuster –- Senior Executive Vice President, Global Group, Health and Long-Term Care and Global Financial Solutions, Allan E. O’Bryant – Executive Vice President, Head of International MarketsEurope/Middle East/South Africa Markets;Allan E. O’Bryant - Executive Vice President, Head of Asia Markets; and Operations, and Donna H. Kinnaird –- Senior Executive Vice President and Chief Operating Officer.Mr. Alain Néemeh, who continuesEXECUTIVE SUMMARYCompany Performance for 2013Overall Company financial results, whether positive or negative, directly affect compensation paid to serve as President and Chief Executive Officer of RGA Canada and head of our Global Mortality Products initiative, was given additional executive responsibilityexecutives. In 2013, compensation for the Company’s Australian operations early in 2012. Ms. Donna Kinnaird joined the Company in April 2012 as Senior Executive Vice President and Chief Operating Officer, a newly created position which is responsible for overseeing our global corporate service functions and special projects. Mr. Allan O’Bryant joined the Company in 2010 and now serves as Executive Vice President, Head of International Markets and Operations. Ms. Kinnaird and Mr. O’Bryant both received reimbursement of expenses related to their relocation to St. Louis, Missouri in 2012 and Mr. O’Bryant received reimbursements associated with an expatriate assignment. For more information on these payments, see Footnote 6 to the Summary Compensation Table. As roles and responsibilities at the Company continue to evolve, we anticipate that there will be additional changes to the list of named executive officers was negatively affected by net operating income that was below both our 2013 plan and our performance in prior years, primarily attributable to a charge to increase claims liabilities in Australia. This decline in operating income decreased the 2014 Proxy Statementpayout under the annual bonus plan and will impact payment under the 2011-2013 PCS grants when payouts are made in future years.Performancefinancial performance demonstrates that our compensation program operates in accordance with our pay for 2012We believe that our compensation philosophy and objectives have resulted in an executive compensation program and decisions that have appropriately incented the achievement of our business performance targets, goals and objectives. Our compensation decisions are intended to benefit our shareholders and drive long-term shareholder value. Summarized below are some key highlights of our financial performance for 2012:2013:$570.9$347.4 million, or 8%4.4%, compared to 2011.2012 increased 6%2013 decreased 30.6% to $516.4$358.4 million, or $6.96$4.95 per diluted share.*12%7.4% for 2012,2013, and has averaged 13%approximately 11% over the last 5 years.*13%7.3% in 2012.2013.**See “Additional Information – Use of Non-GAAP Financial Measures” below.* See "Appendix A: Use of Non-GAAP Financial Measures" for reconciliations to GAAP figures.18Say on Pay Feedback from ShareholdersA primary focus of our Compensation Committee is whether the Company’s executive compensation program serves the best interests of the Company’s shareholders. As part of its ongoing review of our executive compensation program, the Compensation Committee considered the affirmative shareholder advisory vote on executive compensation (“say on pay”) at the Company’s 2012 annual meeting,2013 Annual Meeting, where a significant majority (96%(99% of votes cast on the proposal) of our shareholders approved the compensation program described in the proxy statement for that meeting. Taking the vote into consideration, along with an overall review of the compensation program, the Compensation Committee determined that the Company’s executive compensation philosophy, objectives and elements continue to be appropriate. We did not make material changes to the Company’s executive compensation program during 2012.PERFORMANCEAND PRACTICESHow Our Performance Affected 20122013 CompensationOur emphasis on pay for performance and the alignment of compensation with the creation of long-term shareholder value means that significant portions of the compensation paid to our executives vary based on our corporate performance. Our positive financial results, both positive and negative, are reflected in our 20122013 compensation decisions in the following ways:Based on our operating income and revenue growth performance in 2012,For the Annual Bonus Plan, payouts ranged from 122.5%38.4% to 124.9%99.4% of target for our named executive officers under our annual bonus plan.*

Operatingofficers. Named executive officer ABP payouts are largely based on Company operating income, in 2012 were $516.4 million.* This amount exceeded the thresholdrevenue growth performance goal, but did not reach the target performance level.

Revenue growth in 2012 was 11.5%. This amount exceeded the maximum performance level.

| ▪ | Operating income (weight = 75%) in 2013 was $358.4 million. This amount did not reach the minimum performance level.* |

| ▪ | Revenue growth (weight = 15%) in 2013 was 4.9%. This amount exceeded the target performance level, but did not reach the maximum performance level. |

| ▪ | New business embedded value (weight = 10%) in 2013 was $444 million. This amount exceeded the maximum performance level. |

Our cumulative three-year revenue in 2012 was $26,932.1 million. This amount exceeded the target, performance goal for our intermediate-term incentive awards but did not reach the maximum performance level.

Our three-year operatingrespectively. The relative return on equity measure is dependent upon public availability of financial results from our peer companies. Because of the timing for 2010-2012 exceeded the threshold performance goal foravailability of this information, our intermediate-term incentive awards but did not reach the target performance level.*

Our performance for the relative return on equity metric will not be approved by the Compensation Committee until late April 2014. The weighted average of our cumulative three-year revenue and operating return on equity performance for 2010-2012 exceededthis period has not been determined at this time. Payments for the maximum performance level.

| ▪ | Our cumulative three-year revenue for 2011-2013 was $28,988.8 million. This amount exceeded the threshold performance goal for our intermediate-term incentive award but did not reach the target performance level. |